All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. Sentinel Benefits & Financial Group and its affiliates do not provide tax advice. Sentinel Benefits & Financial Group is the brand name for the Sentinel family of companies which includes Sentinel Benefits Group, Inc., Sentinel Pension Advisors, Inc., Sentinel Insurance Agency, Inc., and Sentinel Securities, Inc. Investment brokerage services offered through Sentinel Securities, Inc. Insurance products offered through Sentinel Insurance Agency, Inc. are separate, unaffiliated companies that are not responsible for each other's services and products.įinancial planning and investment advice are offered through Sentinel Pension Advisors, Inc., an SEC registered investment advisor. Sentinel Benefits & Financial Group and eMoney Advisor, LLC, Broadridge Investor Communication Solutions, Inc., and Zywave, Inc. © 2022 Sentinel Benefits & Financial Group, All Rights Reserved. Still have questions? Please Contact Us for more detailed information on eligible expenses not included on this list.

Breast reconstruction surgery (following mastectomy due to disease).Childbirth expenses (physician, hospital, etc.).Tuition at special school for handicapped.Toothbrush (even if recommended by Dentist).Orthopedic shoes (to the extent the cost exceeds that of normal shoes).Mentally handicapped or disabled person’s cost for special home.

#Hsa eligible expenses full#

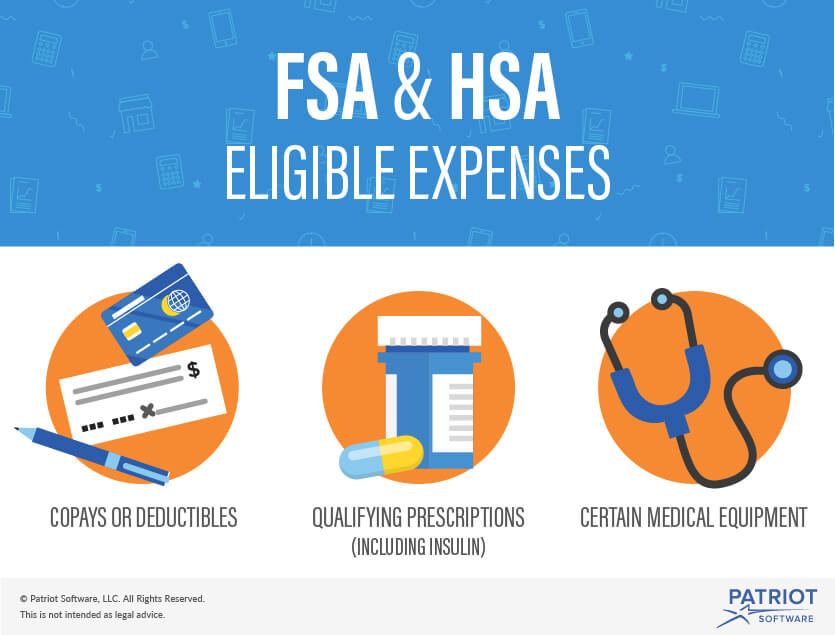

For a full list please refer to IRS Code Section 213(d). Important Note: This list is not meant to be all-inclusive. The below lists may help determine whether an expense is eligible: To help offset the expense, a Flexible Spending Account (FSA) allows you to set aside a portion of your paycheck using pre-tax dollars. Just because they aren’t typically covered by health insurance doesn’t mean you don’t need them. Everything You Need to Know About Your Credit ReportĮyeglasses.Debt Consolidation: One loan to rule them all.Asset Allocation: Help reduce your risk.The Joys and Financial Challenges of Parenthood.

0 kommentar(er)

0 kommentar(er)